Assisted Living Statistics: Population and Facilities

Assisted living provides senior residents with long-term housing and care in a community setting. Assisted living has evolved along with a growing senior population and has become the dominant senior living option. Using the latest available data, we gathered a variety of assisted living statistics, including demographics (age, gender, and race), costs, the current number of residents, and information on how the industry is expected to grow.

Is assisted living the right fit?

Let our free assessment guide you to the best senior living options, tailored to your needs.

Assisted living statistics: An Overview

According to our research team’s analysis of the latest available data:

- More than 818,800 Americans currently reside in assisted living communities, accounting for 88% of all senior residential care community residents.

- There are over 30,600 active assisted living facilities, operating at an average capacity of nearly 80%.

- The median cost of a private, single bedroom unit in an assisted living facility is $4,803 per month.

- With 7 out of 10 people requiring assisted living care in their lifetime, demand is expected to grow by an additional one million beds by 2040.

Read on for breakdowns on resident demographics, the cost of care, and more.

Assisted living resident population statistics

More than 818,800 Americans currently reside in assisted living communities. That’s about 2% of seniors over the age of 65.

Assisted living as a concept is still relatively new. For a long time, nursing homes were the only senior care option available. However, in the 1980s, a more person-centered care model was born — enter assisted living.

Over 30,600 assisted living facilities exist in the United States, with nearly 1.2 million licensed beds available, according to the National Center for Assisted Living (NCAL).

A rapidly growing senior population implies the need for additional assisted living communities, but so does the current generation of middle-aged adults who will require senior housing over the next several decades. Baby boomers are retiring with unprecedented financial assets and strong opinions about the future of senior living. Many want high-quality accommodations and care, in addition to the ability to explore personal passions and interests post-retirement.

From now until 2030, 10,000 baby boomers will reach retirement age each day. Many will seek assisted living options once they’re no longer able to care for themselves independently. By 2040, over 80 million people in the U.S. will be over 65 years old, with that number growing to nearly 95 million by 2060, according to the U.S. Census Bureau.

This near-doubling of the senior population is projected to necessitate almost 1 million additional assisted living beds over the next four decades.

State-by-state information on assisted living communities in the United States

With some states being more densely populated than others, it makes sense that some states will also have more assisted living communities than others. The following data can help you get a better sense of which states have the most and least number of assisted living communities. Note that this data is drawn only from A Place for Mom’s partner communities and is proprietary data.

The five states with the greatest number of assisted living communities are:

- California

- Texas

- Florida

- Washington

- Ohio

The five states with the fewest number of assisted living communities are:

- Alaska

- Wyoming

- North Dakota

- Vermont

- Montana

Assisted Living: What it is and who it helps

Assisted living communities offer long-term housing and care for seniors. Residents often need help with various activities of daily living (ADLs), such as dressing, bathing, and using the toilet, but they do not require 24-hour nursing or medical care. Assisted living provides companionship, personalized care, social activities, and nutritious meals to seniors in a safe, communal setting.

Someone turning 65 today has a seven-in-10 chance of needing some type of senior care as they age, according to the Administration for Community Living and Administration on Aging. With the over-65 population projected to double by 2060, the number of seniors requiring care will increase dramatically over the next four decades.

Assisted living resident demographics

Assisted living communities cater to a wide-ranging population of seniors from various backgrounds. Learn more about the average age, care needs, and length of stay for assisted living residents below.

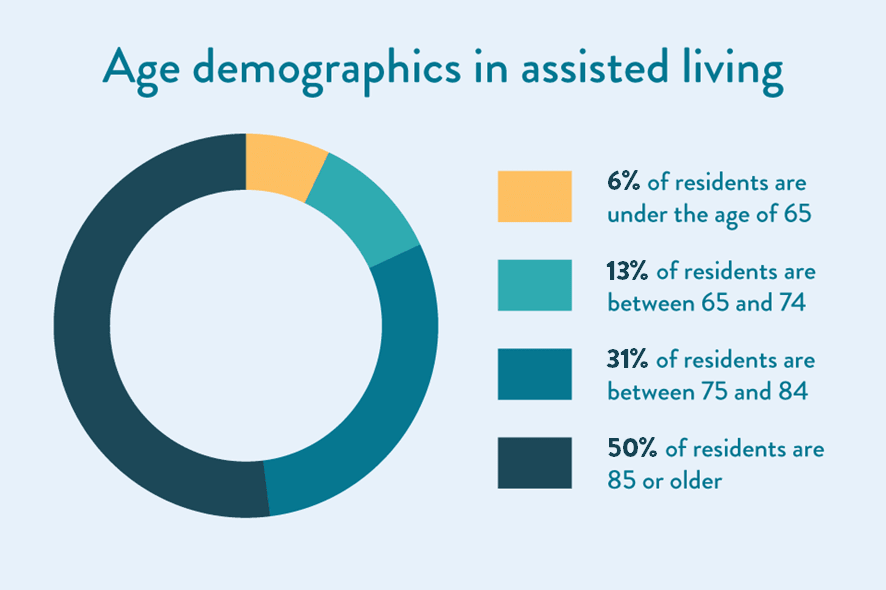

Age demographics in assisted living

The average age of an assisted living resident is 87. While some people transition to assisted living communities as soon as they reach the age minimum, most wait until they need additional care, or until they can no longer remain in their own homes without assistance. Assisted living age requirements vary, but are usually set at 62 or 65 years of age. A small handful may work with those as young as 55.

The majority of residents move into assisted living communities between the ages of 75 and 84, according to the National Association of Real Estate Investment Trusts. In 2023, the NCAL calculated the prevalence of primary age groups as follows:

- 6% of residents are under the age of 65

- 13% range between 65 and 74

- 31% of residents are between 75 and 84

- 50% of residents are 85 or older

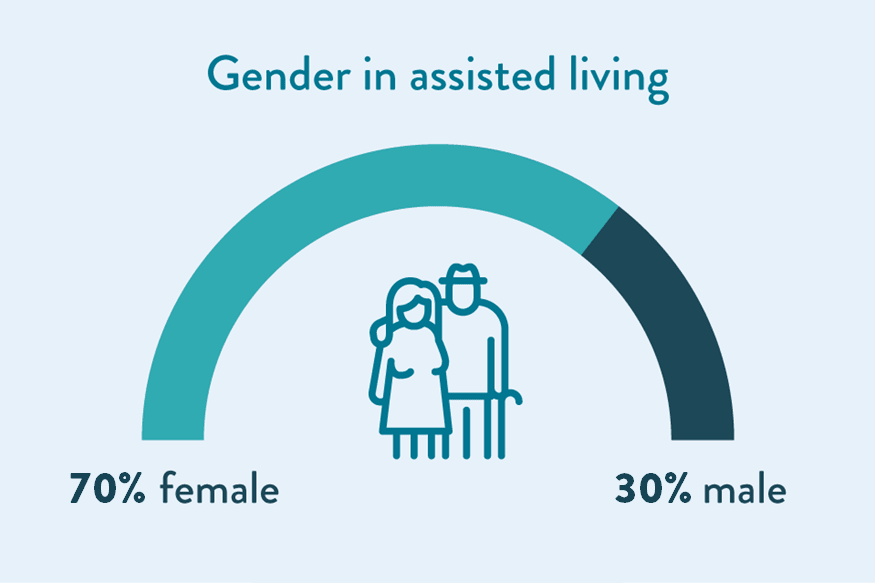

Gender in assisted living

Women in the U.S. tend to live longer than men. The average life expectancy for women was reported to be 79.3 years as of 2021, while the average life expectancy for men was 74.2 years, according to the National Centers for Health Statistics. This disparity contributes to the high female-to-male ratio in assisted living communities.

Approximately 70% of assisted living residents are female, while 30% are male. There is no current data available about non-binary or genderqueer seniors. Here are some additional factors that contribute to the age disparity in assisted living, according to a study published in the journal Age and Ageing:

- Women are, on average, five years younger than male spouses.

- Women are more likely to outlive their male spouses.

- Men are more likely to have comorbidities and chronic conditions that require more comprehensive medical care than assisted living communities provide.

- Men are less likely to have the skills to care for a female spouse at home.

Socioeconomic impact on assisted living statistics

Socioeconomic status inequities strongly affect assisted living residency statistics. Lower-income seniors are more likely to have decreased quality of life, interrupted health care access, and fewer available resources to age comfortably in a community setting. Even middle-income seniors often rely on Medicaid to fund senior care, according to McKnight’s Senior Living.

Why does this affect assisted living statistics? Fewer than 50% of assisted living communities are Medicaid certified, and even those rarely accept Medicaid without additional payment from seniors and their families.

For this reason, only about 18% of assisted living residents rely on Medicaid, according to data from the American Health Care Association and the National Center for Assisted Living. That means the other 82% of seniors in assisted living communities are considered to be upper-middle- or upper-income individuals.

The poverty rate among older adults has decreased by two thirds since the early 1970s. However, as of 2019, nearly 5 million adults over the age of 65 live in poverty. That correlates to 8.9%, with women over the age of 80 reaching nearly 14%, and Hispanic and non-white seniors at even higher levels of poverty, according to the Congressional Research Service. People living below the poverty line, as well as many middle-income seniors who can’t afford paying for assisted living out of pocket, often must turn to in-home family care or state-funded nursing homes, rather than assisted living communities.

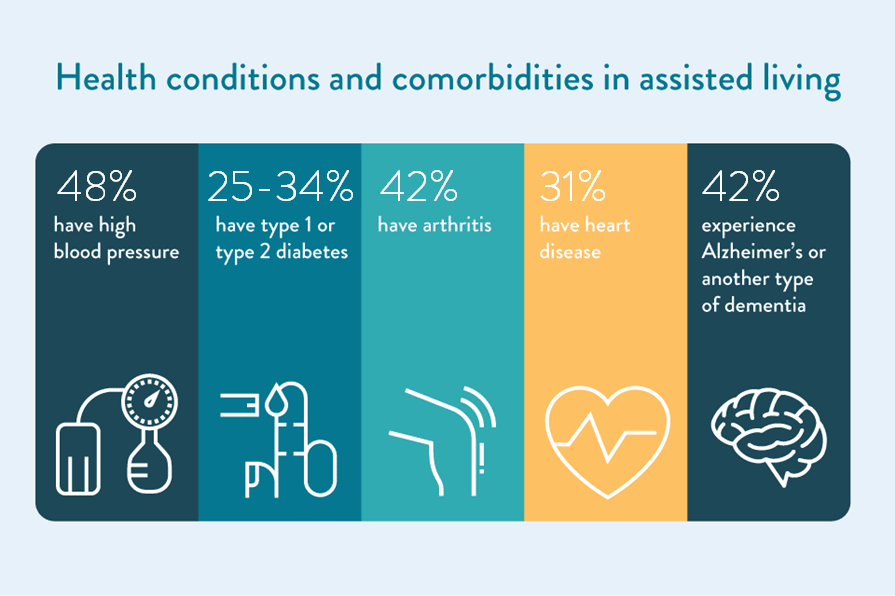

Health conditions and comorbidities in assisted living

As people age, the likelihood of certain progressive diseases and conditions increases. Many assisted living residents require help with these conditions in addition to ADL assistance. Communities are prepared to assist seniors with various common comorbidities. According to U.S. Pharmacist and the NCAL, many assisted living residents experience these conditions:

- 48% of residents have high blood pressure.

- 42% of residents experience Alzheimer’s disease or another type of dementia.

- 42% of residents have arthritis.

- 31% of residents have heart disease.

- 25-34% of residents have type 1 or type 2 diabetes.

Dementia care in assisted living

As the population ages and dementia becomes more prevalent, the percentage of assisted living residents experiencing cognitive decline increases. In 2019, 42% of seniors in assisted living had Alzheimer’s disease or another type of dementia, according to the Alzheimer’s Association 2020 Alzheimer’s Disease Facts and Figures report.

Read related article:Senior Population Statistics: A Portrait of Aging Americans

Is assisted living the right fit?

Let our free assessment guide you to the best senior living options, tailored to your needs.

To cater to this population, many assisted living communities have added memory care wings or sections. Approximately 29% of assisted living communities cater either exclusively to residents with dementia or offer secure, separate environments for memory care.

What services do assisted living residents require?

Many assisted living communities have entry requirements a senior has to meet before admittance. Generally, older adults must require help with at least two ADLs but be able to walk or perform transfers — move from a bed to a wheelchair and back — and swallow without assistance. Many assisted living residents need help with the following ADLs:

- 64% need help with bathing

- 50% need assistance walking, whether from a care aide or mobility device

- 49% need help with dressing and grooming

- 43% need help using the restroom

- 22% require assistance eating, but can generally swallow independently

What is the average length of stay in assisted living communities?

The median length of stay in assisted living communities as of 2023 was 22 months according to the National Center for Assisted Living. Median numbers generally provide a more accurate figure than an average as it isn’t skewed by very high or low numbers. However, this amount of time has been quite variable over the past several years, with many factors contributing to these changes. These include:

Age. Seniors are opting to move into assisted living communities later. This may be because of delayed retirement, increased home safety amenities, finances, or because more home care options are available.

The COVID-19 pandemic. Many seniors delayed a move to assisted living during the height of the Coronavirus pandemic. Other families decided to pull their loved ones from communities until the pandemic subsided.

Financial concerns. As assisted living costs rise, some families may not be able to cope with rent increases. In some states, costs have risen, on average, several hundred dollars a month, according to Genworth’s annual Cost of Care Survey.

Changing care needs or dissatisfaction with care. Since seniors are moving into assisted living communities later in life, their care needs may change more rapidly. Depending on their needs, seniors may transfer from:

- Assisted living to a standalone memory care facility

- Assisted living to in-home hospice care

- Assisted living to round-the-clock home care

- Assisted living to a nursing home

Assisted living industry statistics: 5 Key facts

The assisted living industry has grown and changed enormously over the past 40 years, and it is projected to continue evolving as the population ages. Here are five key takeaways about the future of assisted living.

1. Senior living occupancy is on the rise.

Across the senior living industry, occupied units are at an all-time high, according to data from the National Investment Center for Seniors Housing and Care. Among all care types, assisted living had the largest quarterly gain with occupancy at 80.7%.

Senior living occupancy (including independent living, assisted living, and memory care) has an occupancy rate of 84.2% as of August, 2023.

Approximately 30,600 assisted living communities operate in the U.S., according to the most recent data from the NCAL. Within these communities, there are nearly 1.2 million registered beds. Since the population of people over the age of 65 is anticipated to nearly double by 2060, a comparable increase in assisted living communities is expected.

2. Assisted living is a multi-billion dollar industry.

The U.S. assisted living facility market size was valued at $91.8 billion in 2022 and is expected to expand at a compound annual growth rate of 5.53% from 2023 to 2030, according to Grand View Research market data.

3. Most assisted living communities are for-profit.

More than 80% of assisted living communities are for-profit. However, nonprofit communities continue to gain market share, according to Senior Housing News. Nonprofit communities are often smaller but have higher occupancy rates but perhaps fewer amenities than their larger, national-brand competitors.

4. Assisted living occupancy is increasing after the pandemic.

Between the fourth quarter of 2019 and the first quarter of 2021, the average occupancy at assisted living communities dropped from 87.9% capacity to 75.4% capacity, according to the Statista Research Department. This attrition was likely caused by families seeking other living arrangements during the COVID-19 pandemic.

Assisted living occupancy rose to more than 78% by the end of 2021, according to NIC MAP Vision data released in January 2022. As Coronavirus infection rates continue to decline, occupancy is expected to rise to pre-pandemic numbers.

5. Assisted living communities employ nearly half a million staff members.

As of January 2023, there were approximately 478,500 total employees in the assisted living profession, according to the NCAL. This number represents all staff members, including administrators, sales representatives, care aides, cooks, and custodial and maintenance workers. Among the 478,500, about 298,800 are employed full-time in nursing care or social work roles, including:

- 66% care aides

- 19% licensed practical or vocational nurses

- 15% registered nurses

- 0.8% social workers

Since assisted living facilities aren’t designed for comprehensive medical care, they rarely employ doctors but generally do provide transportation to nearby medical appointments. It’s important to inquire about assisted living staff-to-resident ratios when touring assisted living facilities.

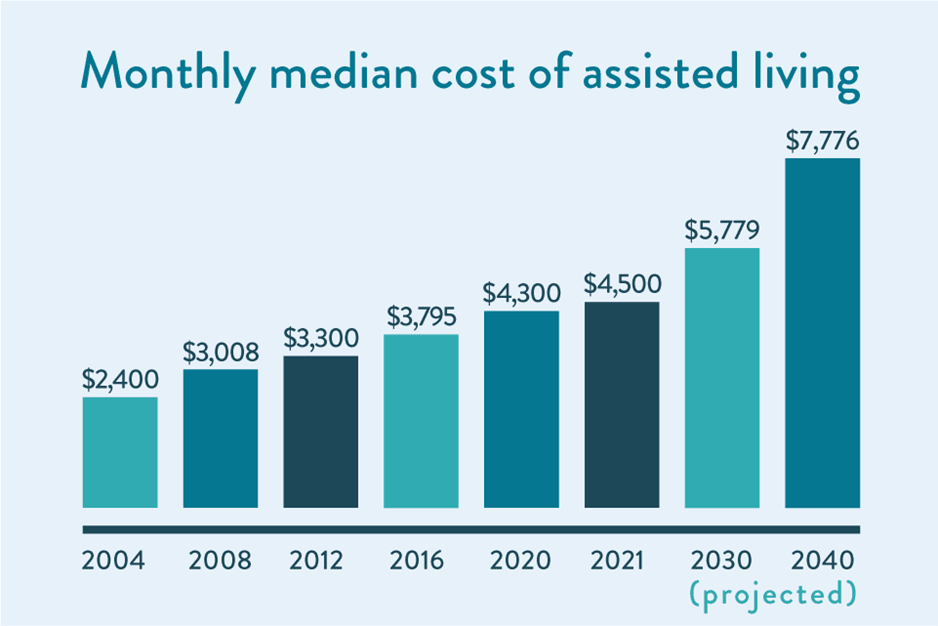

How much does assisted living cost?

According to A Place for Mom’s proprietary data, the nationwide median cost of a one-bedroom assisted living apartment was $4,803 as of 2023. Assisted living costs vary greatly, depending on facility amenities, real estate markets, and geographic location. For example, the median 2021 cost of care in Missouri was $3,000, while care in the District of Columbia was nearly $7,000 a month.

Assisted living costs have risen starkly over the past two decades — Genworth’s first annual cost of care survey, published in 2004, cited just below $2,400 as the median monthly cost of assisted living. This upward trend is expected to continue — by 2030, Genworth estimates the national median cost of monthly care will be $5,779, and it may reach $7,776 by 2040.

Flat rates: Even if costs are broken down in contracts and monthly statements, residents generally pay one flat rate each month. A Place for Mom’s median monthly rate of $4,803 includes most amenities, meals, and assistance with ADLs.

How to pay for assisted living

Many families are surprised to learn that Medicare and Medicaid don’t typically pay for assisted living and that other types of insurance often only cover a small percentage of monthly rent. Most families use private funds to pay for assisted living. This means they use a combination of personal savings, pension payments, and/or retirement or investment income. Often, a senior’s children and family members pay a large share of elder care costs.

Paying for assisted living with insurance

It’s unlikely that insurance will cover a large part of assisted living care. However, some insurance benefits from Medicare, private insurance companies, long-term care insurance, and life insurance policies may apply:

- Medicare only covers short-term, non-custodial care, so you can’t use it to pay for assisted living. However, a policy may cover some medical care, like dialysis or insulin injections, depending on a senior’s care needs.

- Private insurance policies also generally only cover the medical costs of assisted living. Talk with your relative’s insurance agency to learn how to itemize costs.

- Life insurance plans may be able to cover assisted living costs. Family members can sell a policy to a third party for market value or “surrender” an insurance policy at cash value.

- Long-term care insurance (LTCI) policies may cover some costs of care, depending on the provider.

Here’s a breakdown of potential insurance benefits:

| Medicare | Covers medically necessary services |

|---|---|

| Private insurance | Covers medically necessary services |

| Life insurance | Sale of a life insurance policy or its surrender for cash value can cover assisted living costs |

| Long-term care insurance | Covers costs, depending on plan |

Assisted living questions? Get expert help

Tell us your care needs to receive personalized guidance from our advisors.

Paying for assisted living with personal funds and resources

Most families cover assisted living costs with private funds and assets. These may include:

- Home equity and bridge loans

- Pension payouts

- Funds from a 401K, IRA, or other kind of retirement account

- Funds donated by younger family members

Some seniors may be able to cover assisted living costs through other personal benefits, including:

- Veterans Affairs benefits, if eligible

- Railroad or government stipends

- Federal long-term care insurance

Sources

https://www.aarp.org/home-garden/livable-communities/info-2005/fs119_ltc.html

https://www.aarp.org/caregiving/basics/info-2017/assisted-living-options.html

https://academic.oup.com/ageing/article/41/3/416/32196?login=true

https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

https://www.ahcancal.org/Assisted-Living/Facts-and-Figures/Pages/default.aspx

https://www.alz.org/news/2020/death-count-continues-to-grow-in-nursing-homes-and

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1447229/#r9

https://www.apa.org/pi/ses/resources/publications/age

https://www.cdc.gov/nchs/fastats/residential-care-communities.htm

https://www.cdc.gov/nchs/products/databriefs/db456.htm

https://www.cdc.gov/nchs/npals/Survey-methodology-document03152021.pdf

https://www.cdc.gov/mmwr/volumes/69/wr/mm6946a3.htm

https://www.census.gov/library/stories/2019/12/by-2030-all-baby-boomers-will-be-age-65-or-older.html

https://www.census.gov/content/dam/Census/library/publications/2018/acs/ACS-38.pdf

https://data.census.gov/cedsci/table?q=DP05&t=Older%20Population&tid=ACSST1Y2019.S0102

https://academic.oup.com/gerontologist/article/47/suppl_1/8/614189

https://www.grandviewresearch.com/industry-analysis/us-assisted-living-facility-market

https://mylifesite.net/blog/post/food-for-thought-how-ccrc-meal-plans-work/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2588026

Assisted living in all states

The information contained on this page is for informational purposes only and is not intended to constitute medical, legal or financial advice or create a professional relationship between A Place for Mom and the reader. Always seek the advice of your health care provider, attorney or financial advisor with respect to any particular matter, and do not act or refrain from acting on the basis of anything you have read on this site. Links to third-party websites are only for the convenience of the reader; A Place for Mom does not endorse the contents of the third-party sites.

Assisted Living options tailored to your needs

Assisted Living options tailored to your needs