Is Assisted Living Tax Deductible?

Yes, some assisted living expenses can be deducted on a federal tax return. The medical expense portion of assisted living that exceeds 7.5% of your adjusted gross income (AGI) is deductible. Most states also offer a medical expense deduction, but the rules vary. In general, products and services such as medications, medication management, physical and occupational therapy services, and transportation to medical appointments are deductible. Additionally, long-term care assistance is deductible for those who meet certain criteria. Nonmedical expenses, such as room and board, don’t qualify as tax deductions. When in doubt, always consult a tax professional.

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

Key Takeaways

- The IRS considers the medical portion of assisted living expenses to be tax deductible when they exceed 7.5% of a person’s adjusted gross income (AGI).

- Long-term care expenses are also deductible as long as the person meets the IRS’ definition of chronically ill.

- Nonmedical expenses aren’t deductible and include rent, meals, and products and services that weren’t prescribed by a health care provider.

- You can claim your loved one’s eligible care costs as tax-deductible expenses if you pay for at least half of their support.

How assisted living falls under the IRS’ medical deduction

Medical expenses that are more than 7.5% of your AGI are eligible for the medical deduction, according to the IRS.[01] The IRS defines medical expenses as the cost of equipment, supplies, devices, and services whose purpose is to diagnose, cure, mitigate, treat, or prevent disease that affects any body part or function.

Other assisted living costs such as room and board, personal grooming services, nonprescription medicine, health club dues, and other services and products that don’t meet the IRS’ definition of medical expenses aren’t deductible.

When is assisted living tax deductible?

The medical expense portion of assisted living costs is deductible when a health care provider has documented the need for those products and services as part of a patient’s overall care plan.

Long-term care expenses are also tax deductible for people who are considered to be chronically ill. The IRS defines a chronically ill person as someone whose health care provider has documented in their care plan that they need assistance with two or more activities of daily living (ADLs). These include:

- Bathing

- Dressing

- Eating

- Toileting

- Transferring

- Continence

A person is also considered chronically ill if their health care provider has determined that they need substantial supervision to stay safe due to cognitive impairment.[01] This means that many memory care expenses are also tax deductible.

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

What assisted living expenses are tax deductible?

Room and board and other nonmedical expenses aren’t deductible, but many of the services that your loved one receives in their assisted living community will qualify for the medical expense deduction. Because someone who needs help with at least two ADLs meets the definition of being chronically ill, assistance with personal care tasks is considered medical in nature for these individuals. While these services are classified as nursing care by the IRS, they don’t have to be administered by a nurse. The IRS maintains a list of eligible medical expenses, with specific guidance on which assisted living expenses can be deducted.

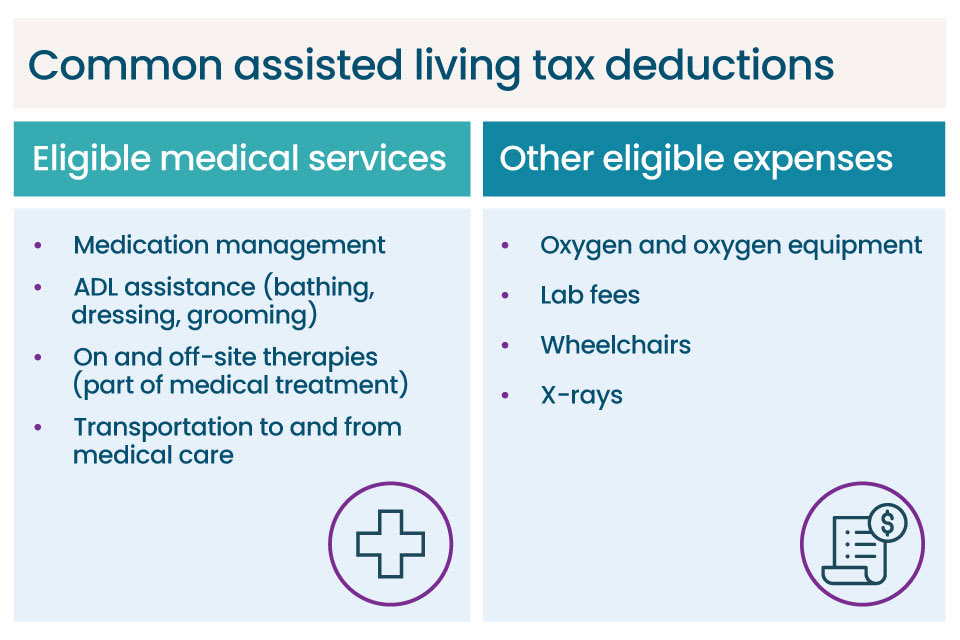

Here are some common assisted living expenses that are generally tax deductible:

- Medication management

- Prescription medications

- Assistance with ADLs

- Therapies that are part of medical treatment or a plan of care

- Dementia care services

- Transportation to and from medical appointments

This isn’t an exhaustive list, and your loved one may have other medical expenses that qualify for a tax deduction, such as durable medical equipment, hearing aids and repairs, eyeglasses and contacts, and laboratory fees. Equipment, such as a wheelchair, is only deductible in the year it was purchased. Equipment rental fees are also deductible. If you’re unsure about what you can deduct, consult a tax professional.

Can I claim my parent’s assisted living expenses?

Yes, you can claim your parent’s eligible assisted living expenses on your federal tax return, provided that certain conditions are met. According to the IRS, you can deduct the total cost of medical expenses for yourself, your spouse, and your dependents that exceeds 7.5% of your AGI.

To claim a parent as a dependent on your federal tax return, they must meet all of these requirements:

- They must receive more than half of their support from you.

- Their gross income for 2024 must be less than $5,050.

- They must meet U.S. residency requirements.

- They must not file a joint tax return.

Also, the IRS requires that the person needs to be your dependent either at the time they received the medical services or at the time you paid for them.[01]

If your parent has a relatively low gross income, you might wonder whether their Social Security benefits are included in the annual income limit. This will vary, but you can expect that a percentage of their Social Security benefits will count towards their gross income.

Even if you can’t claim your parent as a dependent, you may still receive the medical expense deduction through specific exceptions. Essentially, this applies if you could have claimed your parent as a dependent except that:

- Their gross income was more than $5,050 in 2024, or

- They filed a joint return, or

- You (or your spouse, if filing a joint return) could be claimed as a dependent on someone else’s return.[01]

If you need help talking about assisted living with your loved one, this guide offers helpful strategies.

Expert advice for affordable assisted living

Tell us your care needs to receive options tailored to your budget.

How do I deduct assisted living expenses?

Whether you prepare your own taxes or you have help from a tax professional, you’ll need an itemized list of services, equipment, and supplies to determine how much you spent on all medical expenses during the year. Ask your loved one’s assisted living community to provide a breakdown of services so you can see what portion of their expenses constitute medical care. You’ll also need to file an itemized return rather than take the standard deduction.

On a federal tax return, 100% of medical expenses that are over 7.5% of your AGI are eligible for the medical expense deduction. For instance, if your AGI is $100,000 and you spend $10,000 on eligible medical expenses, the amount you can deduct is $2,500. The first 7.5% — in this case, $7,500 — is not deductible.

At the state level, the rules for deductible medical expenses vary. Most states, but not all, also allow for some amount of medical expenses to be deducted. In states that do allow this deduction, most have set the threshold at 7.5% of your federal AGI. But a few states use higher or lower thresholds.[02] For example:

- Arizona. All qualified medical expenses are fully deductible.[03]

- Alabama. Qualified medical expenses greater than 4% of a person’s state AGI are deductible.[04]

- New York. Qualified medical expenses greater than 10% of a person’s federal AGI are deductible.[05]

Additional resources

If you’re unsure how much you’ll be able to save using the medical expenses deduction, speak with a tax professional. If the tax savings aren’t sufficient to offset the cost of care, you and your loved one may decide to look into other payment options for long-term care or to find more affordable assisted living. The Senior Living Advisors at A Place for Mom have decades of experience helping families find and afford assisted living. At no cost to you, they can provide information about payment options and local communities’ rates.

Internal Revenue Service. (2024, November 18). Publication 502, medical and dental expenses.

Davis, C. (2020, February 5). State itemized deductions: Surveying the landscape, exploring reforms. Institute on Taxation and Economic Policy.

Arizona Department of Revenue. (2025, January 1). 2024 Form 140 schedule A itemized deduction adjustments.

Alabama Department of Revenue. 2024 Form 40 booklet.

New York Department of Revenue. Form IT-196 New York resident, non-resident, and part-year resident itemized deductions.

Assisted living in all states

The information contained on this page is for informational purposes only and is not intended to constitute medical, legal or financial advice or create a professional relationship between A Place for Mom and the reader. Always seek the advice of your health care provider, attorney or financial advisor with respect to any particular matter, and do not act or refrain from acting on the basis of anything you have read on this site. Links to third-party websites are only for the convenience of the reader; A Place for Mom does not endorse the contents of the third-party sites.

Find assisted living that fits your needs and budget

Find assisted living that fits your needs and budget